37 Retirement

Learning Objectives

Key Points

- Retirement refers to when someone decides to quit or completes his/her desired period of work for a company.

- Retirement planning will help you to survive life after the completion of your job.

- A retirement letter includes formal information about the employee and their plans.

Definition Of Retirement

The term “retirement” refers to the moment in one’s life when he or she decides to quit the workforce permanently.

In the United States and most other industrialized countries, the typical retirement age is 65, with many of them having some form of government pension or benefits system in place to augment retirees’ salaries.

The Social Security Administration (SSA) in the United States, for example, has been providing monthly Social Security cash benefits to retirees since 1935 (Kagan, 2021).

Types of Retirement

-

Disability Retirement:-You may file for disability retirement as a member if you are mentally or physically disabled from performing your duty and your disability is likely permanent, regardless of your age or years of service credit.

-

Early Retirement:-Early retirement refers to when a person stops working before reaching the statutory retirement age.

-

Voluntary Retirement:-The term VRS refers to a voluntary retirement program-me in which an employee is given the option to leave their job before their retirement date. Companies can use the system to reduce staff strength. Both the public and private sectors can apply it.

-

Deferred Retirement:-Employees who depart the federal service with at least five years of creditable civilian service before becoming eligible for immediate retirement are eligible for a deferred retirement.

Retirement Strategies

- Retirement planning

- Calculating how much you need to retire.

- Invest in retirement plans.

- Planning for social security in retirement

- Understanding pensions

- Getting insurance

Techniques can help

- Budget

- Maximize your contributions to your 401 (k)

- Contribute to IRAs

- Pay off bad debt.

- Buy our investment products

- Save every extra penny you can (Whitney, 2017).

Retirement Planning

Retirement planning entails ensuring a constant flow of income after retirement. It means putting money away and investing it, particularly for that purpose. Your retirement approach will be determined by your long-term objectives, income, and age

Why is it important to plan for your retirement?

It can be costly to grow old. Medical bills are only going to climb, even though frivolous expenses may decrease. When inflation is considered, not having enough money to cover future needs can be stressful and worrying. The goal of a retirement investing strategy is to achieve financial independence in your later years without relying on others. The following are four reasons why everyone should have a retirement fund:-

- Social retirement benefits aren’t available.

- Financial autonomy.

- Costs are going up.

- Emergency medical care.

Planning For Retirement

Everyone’s life revolves round retirement planning. Given the rising rate of inflation and the limited social security program-mes available to older adults, it is critical that you begin planning for your retirement as soon as possible.

Preparing for retirement is a lot like preparing for a trip: nothing ever happens as planned. However, the better the strategy, the better the result. When things go wrong, you need to be able to adjust to shifting conditions. You never know what retirement will be like until you arrive.

Making a smooth transition by “practicing retirement” is an important part of any retirement strategy. Consider it a dress rehearsal before you make the big (and often irreversible) decision to retire completely (Anderson, 2016).

- Before you retire, make a financial plan.

- You will need to be able to rebuild your finances once you retire.

- It is not as simple as it appears to keep your way of life.

- Inflation is a matter of survival.

- Making the transition to retirement is not easy.

- Are you going to be busy or bored?

- It is all up to you.

- Where have all of my “friends” gone?(Quinn, 2019).

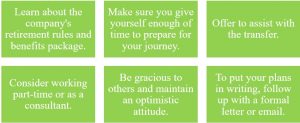

Here are some more moves to make that will help you ensure a smooth transition to your golden years:-

- Take a few more weeks break.

- Alter your working hours.

- Spend a total of four seasons in your retirement community.

- Make friends with people who have already retired and are doing things you enjoy.

- Start new activities or rekindle existing ones.

- Take a step forward.

- If you intend to stay in your house, undertake costly repairs now.

- Rely only on your pension income.

- Rekindle the bonds that are most essential to you.

- Every week, try something new.

You never know what amazing adventures await you. A little planning ahead of time will help you be more prepared to enjoy them. (Anderson, 2016).

Retirement Eligibility

The minimum duration of qualifying for a pension is ten years. After completing at least 10 years of qualifying service, a Central Government employee who retires in line with the Pension Rules is entitled to a pension.

Retirement Policies

- Allow workers over the age of 65 to opt out of extra social security contributions.

- It allows employers to offer pro-rated fringe benefits to employees who work less than full-time hours rather than requiring all employees to get the same incentives.

- Make Medicare the primary source of health-care coverage for those over the age of 65.

- Extend the Earned Income Tax Credit to workers aged 65 and over who are single and have no dependent children (QUINN*, 2000).

Death/Retirement Gratuity

-

Retirement Gratuity;-This is attributed to the departing government employee. A minimum of 5 years of eligible service and eligibility for service gratuity/pension are required for this one-time lump sum payment. For each completed six-month period of qualifying service, On the date of retirement, the retirement gratuity is calculated as 1/4th of a month’s Basic Pay plus Dearness Allowance. The amount of gratuity is not limited in any way. The retirement gratuity is 1612 times the Basic Pay plus DA, up to a maximum of Rs. 20 lakhs, for qualifying service of 33 years or more.

-

Death Gratuity:-This is a one-time lump-sum payment made to the nominee or family member of a government employee who dies in the line of duty. There is no requirement that the dead employee serve for a certain amount of time. The following rules govern death gratuity entitlement:-

| Qualifying Service | Rate |

| Less than one year | 2 times the basic pay |

| One year or more but less than 5 years | 6 times the basic pay |

| 5 years or more but less than 11 years | 12 times the basic pay |

| 11 years or more but less than 20 years | 20 times the basic pay |

| 20 years or more | half of emoluments for every completed 6 month period of qualifying service, subject to a maximum of 33 times of emoluments. |

What is a retirement letter?

A retirement letter is a formal written letter informing your employer of your retirement plans. This is similar to a resignation letter, in that it informs your employer that you are leaving your position. The main difference between a retirement notice letter and a resignation letter is that you are not only leaving the company but also looking for retirement benefits.

A retirement letter is usually accompanied by a verbal notice to your immediate supervisor. Before sending your retirement letter, you might want to organize a meeting to discuss your plans to retire.

What does a retirement letter include?

The retirement letter should include the following information as a formal written notification:-

- Any provisions for the transition, if relevant

- Job Title

- Company Name

- Notice period

- Last day you intend to work

How to Use a Retirement/Resignation Letter

- Offer thanks and appreciation

- Detail your history with the company.

- Write about future plans.

- Last day on the job

Tips for Notifying Your Employer of Your Retirement

While you’re embarking on a new chapter in your life, keep in mind that you’ll be leaving behind a career for which you’re well qualified and have years of expertise to offer. Due to retirement, resigning will leave an open job that may be difficult to fill. Make sure you speak with your supervisor about your plans in person before sending a letter. (Doyle, 2020).

Important points for Writing a Retirement Letter to your Employer

- Given a timeline

- Mention your company’s achievements.

- Thank you and offer your services.

- Human Resources should receive the mail.

- Give your contact details.

Templates for Retirement Letters

To assist you in writing your own retirement letter, below is a template as well as some sample letters. If you’re sending your letter by email, omit the employer’s contact information and include yours at the conclusion. Your email’s subject line should be clear and descriptive.

“Retirement – First and Last Name.”

Your Name

Your Address

Your City, State, Zip Code

Your Phone Number

Your Email Address

Date

Employer Contact Information

Name

Title

Company

Address

City, State, Zip Code

Salutation

Dear Mr./Ms. Last Name:

First Paragraph

Advise your employer that you will be retiring and give the effective date.

Middle Paragraph

Thank your employer for the opportunities provided during your tenure with the company.

Final Paragraph

Offer to provide assistance during the transition.

Complimentary Close

Respectfully yours,

Your Signature (hard copy only)

Your Typed Name (Doyle, 2020).

Sample 1

Enid Baker

Hatch Library

87 Felix Ave.

Charleston, SC 29401

Dear Ms. Baker:

I am writing to inform you that as of February 15, I’ll be leaving Hatch Library as a reference librarian. I would want to express my gratitude for all of the tremendous possibilities you’ve provided me as a Hatch Library employee. For the past 20 years, I’ve enjoyed working with and learning from my coworkers, and I’m ready to move on to the next stage of my life. Please let me know if there is anything I can do to help you with this transition.

Sincerely,

Barbara Schultz

Sample 2

Margaret Price

123 Main Street, Any Town, CA 12345

September 1, 2018

Ms. Janice Smith

Marketing Manager

Tech tron Mobile

8976 W. Fourth St.

Plano, TX 02987

Dear Janice:

This letter serves as official notice to you and my employer that I will be leaving Tech tron Mobile on January 11th. I intend to retire on that date. I am looking forward to my impending retirement, but I wanted to thank you for all of the chances I have had while working with Tech tron Mobile. I have had a great time working as a Marketing Communication Specialist, and I will miss you and my co-workers when it’s time for me to retire. Please let me know if there is anything I can do to assist you with the transfer of my work to another staff. I intend to work until my retirement date and will be pleased to assist you in making a smooth transition. If you decide to replace me, I’ll even assist you in finding someone to do so. Again, I have thoroughly enjoyed my time at Tech tron Mobile and will definitely miss my coworkers and our office.

For the future, I wish you nothing but the best. If you require any extra information, please do not hesitate to contact me. I will be meeting with HR soon to formalize the terms of my retirement, hear about any perks that extend beyond retirement, and see if there’s anything I can do to help with the transition of my work to another employee.

Sincerely,

Handwritten Signature

Margaret Price

Sample 3

Dear Kart,

I have mixed emotions about announcing my resignation from Consolidated Industries, which will take effect on March 15, 2017.

I have spent the most of my professional life here, and I have been fortunate to work with so many great and wonderful people throughout the years. We were a little firm in an out-of-the-way office park when I started as a customer support agent in 1980. I am still shocked that we now occupy an entire level of the Main Street office building and employ over 150 people.

Though I will be sad to go, I am looking forward to spending more time with my family and having the opportunity to travel. Please let me know if there are any other actions I can take to make this move easier.

Sincerely,

Benny Johnson

Common Mistakes by Employees

- Delaying on saving

- Ignoring costs

- Not securing your information

- Emphasizing college savings over retirement

- Not diversifying your portfolio

- Waiting for the perfect moment to invest

- Having insufficient insurance

- Withdrawing money from your accounts early (Krantz, 2020).

References

https://www.opm.gov/retirement-services/csrs-information/types-of-retirement/

https://www.trs.texas.gov/Pages/active_member_disability_retirement.aspx

https://www.collinsdictionary.com/dictionary/english/early-retirement

https://www.business-standard.com/about/what-is-voluntary-retirement-scheme

https://www.govexec.com/pay-benefits/2007/06/deferred-vs-postponed/24758/

https://www.franklintempletonindia.com/article/head-start-15-io04og35/importance-of-retirement-planning

https://pensionersportal.gov.in/retire-benefit.aspx

https://www.google.co.in/books/edition/Retirement_Planning_For_Dummies/OVLHDwAAQBAJ?hl=en&gbpv=0

https://www.indeed.com/career-advice/career-development/retirement-letter

https://www.monster.co.uk/career-advice/article/sample-retirement-letter

https://eforms.com/resignation-letter/retirement/#what-to-include

https://www.thebalancecareers.com/retirement-letter-example-to-notify-employer-2063065

https://www.thebalancecareers.com/retirement-letter-sample-1918917

https://eforms.com/resignation-letter/retirement/#sample1

Anderson, N. L. (2016). 10 Things To Do Within 5 Years Of Retirement. Retrieved from https://www.forbes.com/sites/nancyanderson/2016/02/16/10-things-to-do-within-5-years-of-retirement/?sh=c8872bd251af

Cleartax. (2021). Pension Plans. Pension Plans : Features, Benefits, Types. Retrieved from https://cleartax.in/s/pension-plans

Doyle, A. (2020). Retirement Letter Template, Examples, and Writing Tips. Tips for giving notice of Retirement. Retrieved from https://www.thebalancecareers.com/retirement-letter-example-to-notify-employer-2063065

Kagan, J. (2021). Retirement Planning. Retirement. Retrieved from https://www.investopedia.com/terms/r/retirement.asp

Krantz, M. (2020). Retirement Planning For Dummies. 352. Retrieved from https://www.google.co.in/books/edition/Retirement_Planning_For_Dummies/OVLHDwAAQBAJ?hl=en&gbpv=0

QUINN*, G. B. (2000). RETIREMENT TRENDS AND POLICIES TO ENCOURAGE WORK AMONG OLDER AMERICANS. 1-39.

Quinn, R. (2019). 10 retirement lessons from a retired retirement pro. How to plan, save and keep calm. Retrieved from https://www.marketwatch.com/story/10-lessons-from-retirement-2019-01-25

Whitney, R. (2017). Rock Retirement. A Simple Guide to Help You Take Control and Be More Optimistic About the Future, 257. Retrieved from https://www.google.co.in/books/edition/Rock_Retirement/9q42DwAAQBAJ?hl=en&gbpv=0