15 What are the tax differences between a full-year, part-year and deemed resident?

Gurprem Dhaliwal

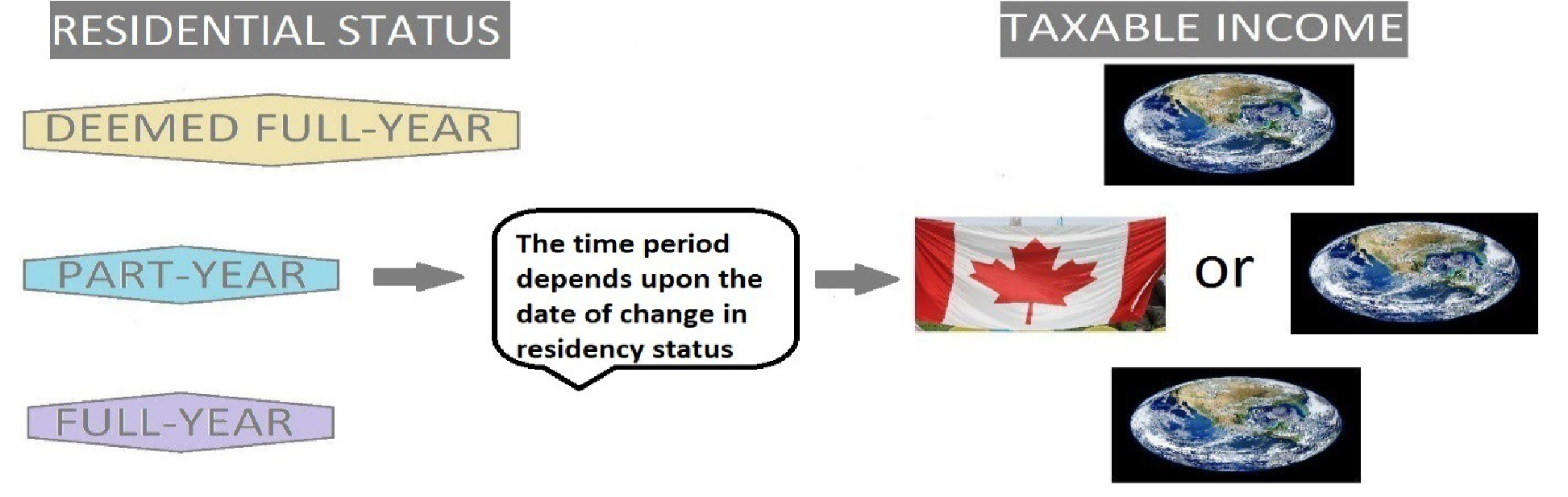

Part-year residents: ITA 114 states that any person who establishes residential ties in Canada or leaves Canada with an intention to settle somewhere else during a calendar year is considered a part-year resident.

Part-year residents are taxed on their income both inside and outside Canada (“worldwide income”) for the portion of the year that they are residents of Canada. They are taxed on Canadian-source income only, during the period when they are non-residents of Canada (ITA 114). For example, if a person is a resident of Canada for eight months in a tax year, they are taxed in Canada on their worldwide income for eight months they are resident and taxed on their Canadian source income for the four months they are non-resident.

Deemed residents: It is mentioned in ITA 250(1)(a) that there are certain individuals who Canada says are residents of Canada regardless of typical residential rules (such as dwelling place, spouse, kids). This includes people like military stationed overseas, and Canadian ambassadors. Also, a person who sojourns (frequently moves between Canada and foreign countries) in Canada for a period of 183 days or more is considered a deemed resident.

Deemed residents are taxable in Canada on their worldwide income (ITA 250) for the year. Deemed residents are different from part-year residents because part-year residents leave or enter Canada permanently; whereas, deemed residents’ stay is temporary. For example, a person who lives in Bellingham, Washington but commutes to Surrey, B.C. for work 200 days in a year, is a deemed resident as they exceed the 183-day rule.

Full-year residents: According to Canadian Revenue Agency (“CRA”), full-year residents are those persons who have significant residential ties in Canada throughout the year.

Full-year residents are taxable in Canada on their worldwide income. For example, Daniel is a full-year resident of Canada and he lives in Vancouver. He makes $50,000 as an employee at Vancity Credit Union and has $15,000 in net rental income from a rental property in Seattle, USA. He will be taxed in Canada on his $50,000 of Canadian employment income and his $15,000 in U.S. rental income.

Interactive content (Author: Gurprem Dhaliwal, March 2019)

Interactive content (Author: Yinzi Mao, June 2019)

References and Resources:

- ITA- 114, 250, 250(1)

- Video- “Tax and Residency in Canada” (Author: John Mcllroy)

- Article-“Factual Residents- Temporarily outside of Canada” (Author: Canada Revenue Agency)

- Competency map: 6.5.1

January 2019

Media not mentioned below is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) and owned by the author of the text.

Media Attributions

- Image – “Earth” © NASA is licensed under a CC BY (Attribution) license