31 What are the general rules for deduction of home office expenses for an employee vs self-employed?

Chanpreet Kang

For employees home office expenses may be deductible if “the workplace is where the individual principally performs the duties of the office or employment used exclusively during the period in respect to earning income”. ITA 8(13)(a).

For self-employed individuals home office expenses may be deductible if the home office is “(i) the individual‘s principal place of business, or (ii) used exclusively for the purpose of earning income from business and used on a regular and continuous basis for meeting clients, customers or patients of the individual in respect of the business;” ITA 18(12).

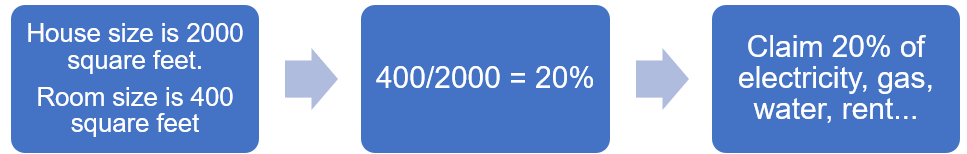

Wherever you spend most of your time working is your workplace. When one is working at home as either an employee or self-employed there are a few expenses you can deduct from your income. These expenses range from electricity to gas and ordinary office supplies like pens and paper clips. When you are employed or self-employed you can deduct a portion of most costs to operate your home (electricity, gas, water rent, maintenance etc.). Since it is very difficult to determine the actual amount of these costs used by your home office, the square footage rule is used to allocate these expenses.

Although not perfect the square footage rule provides a reasonable allocation of costs to the home office. Note that mortgage interest is not a deductible home office expense for employees but is deductible for individuals who are self-employed. You also cannot deduct objects like chairs and tables, the reason being is because they are capital items and not expenses. You also can not deduct house expenses that do not affect your workplace in any way.

It is important to note that home office expenses cannot be used in a year to increase or create a loss. In this situation the expenses may be available to be applied against income in other years.

Interactive content (Author: Chanpreet Kang, March 2019)

Interactive content (Author: Amanda Cheung)

References and Resources:

- ITA 8(13), 18(12)

- Article – “Work-space-in-the-home expenses” (Author: Government of Canada)

- Article – “Business expenses.” (Author: Government of Canada)

- Competency map: 6.3.2

January 2019

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.