35 Are foreign students in Canada eligible for residency? Are they eligible for all relevant tax credits?

Kaur Rajdeep

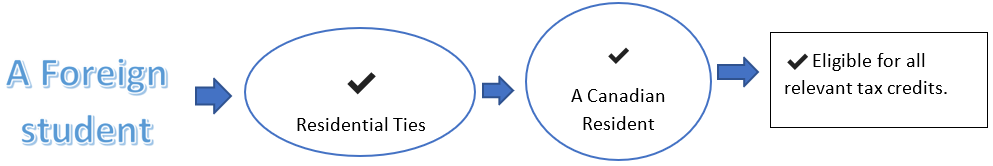

Canadian tax residency rules apply equally to everyone. So, if a foreign student meets the Canadian residency requirements then they are considered to be a tax resident of Canada and are eligible for all relevant tax credits.

As a refresher, tax residency in Canada is assessed based on Primary and Secondary residential ties. Primary residential ties include having dependants, a spouse or a home in Canada. Secondary residential ties include personal property, social ties, a driver’s license, and medical insurance coverage. CRA considers all these factors when assessing an individuals tax residency status.

Foreign students that are considered Canadian residents for tax purposes are eligible for all relevant tax credits (for example, tuition tax credits). The tax credits available to non-residents are more complicated and I suggest you go to the CRA guide (link in references) for further details.

The Canadian tax system is based on residency, not citizenship; Therefore, if an international student is a resident, they should enjoy the benefits just like another resident. So remember, if you are an international student who is considered a resident in Canada for tax purposes, you are eligible for all the tax credits available to a Canadian resident student who was born in Canada.

Interactive content (Author: Kaur Rajdeep, January 2019)

Interactive content (Author: Sammi Hoang, January 2020)

References and Resources:

- Article – “Taxes for international students studying in Canada.” (Author: Government of Canada)

- Guide- “General Income Tax and Benefit Guide for Non-Residents and Deemed Residents of Canada.” (Author: Government of Canada)

- Article- “Tax information for International Students in Canada.” (Author: TurboTax)

- Competency map: 6.3.2

January 2019

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.