28 What is an allowance? What is a reimbursement? How are they treated differently for tax purposes?

Langsha Tao

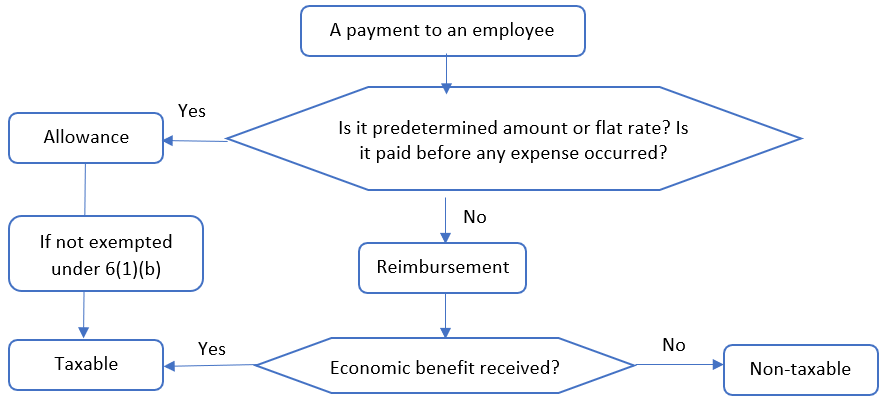

An allowance is a predetermined amount or flat rate which is paid to an employee for an expense incurred (use of automobile for work, meals while travelling for work etc.) and is not required to be substantiated by receipts. Reimbursements involve a repayment for an expense incurred. In the most common scenario you purchase something for work, give your employer the receipt and they ‘reimburse’ you for your payment.

For tax purposes, all allowances received must be included in employment income, unless specifically listed as an exception under ITA 6(1)(b). Most ‘reasonable’ allowances (as described in 6(1)(b)) are not included in income. If the allowance does not meet the exceptions listed in 6(1)(b) it has to be included in your employee’s income as a taxable benefit.

If the payment is a reimbursement, then a further determination must be made as to whether the employee has received an “economic benefit” (for example, the reimbursement exceeded the amount actually spent by the employee). Generally, a reimbursement is not a taxable benefit to the employee, but if there is an “economic benefit”, the benefit is taxable.

One very common allowance occurs when an employer pays an employee that is using their own automobile for work purposes. For this to be considered a ‘reasonable’ allowance as described in 6(1)(b) and therefore not taxable, the following three conditions must be met:

- The allowance is based only on the number of business kilometers driven in a year;

- The rate per-kilometer is reasonable (The CRA rate in 2019 is 58¢ per kilometer for the first 5,000 kilometers driven; 52¢ per kilometer driven after that);

- You did not reimburse the employee for expenses related to the same use of the vehicle”.

Interactive content (Author: Langsha Tao, March 2019)

Interactive content (Author: Simon Chen)

References and Resources:

- Article – “Reasonable per-kilometre allowance” (Author: Government of Canada)

- Article – “Taxable Benefits and Allowances” (Author: Government of Canada)

- Competency map: 6.3.2

March 2019

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.

Image Description

Figure 27.1 Image Description: A payment to an employee if predetermined or flat rate, unless exempt under 6(1)(b), is taxable (allowance). If not predetermined or flat rate, taxable only if economic benefit received (reimbursement). [Return to Figure 27.1]