7 How do you get from Net Income for Tax Purposes to Taxable Income to Tax Payable?

Gurveer Brar and Marc Kampschuur

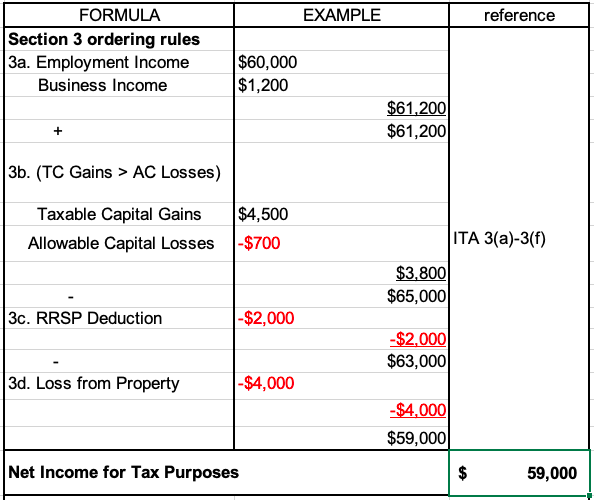

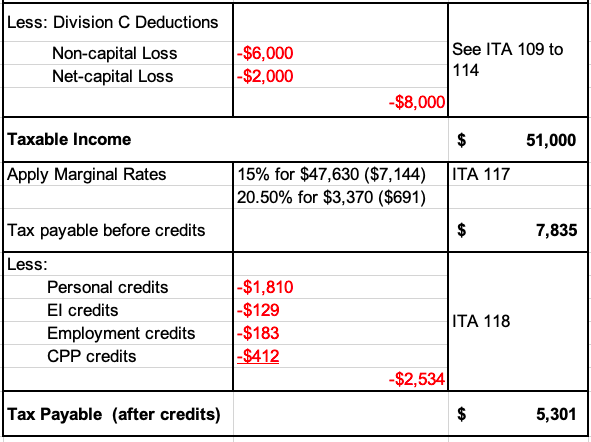

After determining Net Income for Tax Purposes (“NIFTP”) using the Section 3 ordering rules, Division C deductions are subtracted to get to the Taxable income (note, don’t confuse Division ‘C’ deductions with section 3(c) deductions). Then Marginal rates are applied to the Taxable Income to calculate the Tax Payable before credits. Lastly, credits are deducted to get to the Tax Payable. Note that credits are often calculated with reference to NIFTP (thus an amount such as WCB that is included in NIFTP and deducted to arrive at Taxable Income will not affect the calculation of tax payable before credits but may reduce credits available).

This process is best illustrated with an example using 2019 marginal rates and tax credits.

Interactive Content (Author: Anthony Au, June 2019)

Interactive Content (Author: Sam Newton, June 2019)

This is a video walkthrough of a tax payable worksheet originally prepared at BCIT (author unknown). Note, some tax rates and credits used in the video may be slightly outdated but the concepts remain the same.

References and Resources:

- ITA – 3(a)-(f), 109-114, 117, 118

- Competency map: 6.3.2

January 2020

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.