27 What is the purpose of CCA? How is it calculated? Why are items typically ‘pooled’ into the same CCA class?

Daljinder Nijjar

Capital Cost Allowance (“CCA”) is the depreciation mechanism used for tax purposes. Unlike accounting depreciation, CCA can be deducted from income for tax purposes. Capital assets require depreciation because the capital assets wear out over time. Undepreciated Capital Cost (UCC) is the capital cost of an asset minus the CCA claimed in previous years.

How is it calculated?

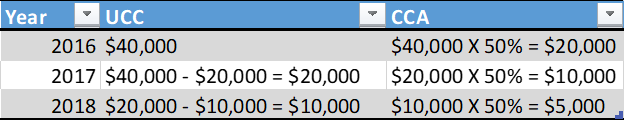

CCA is usually calculated based on the Declining Balance Method. Let’s consider the following example: Assume Alpine Industries has machinery with an Undepreciated Capital Cost (UCC) of $40,000 at the start of 2016. The machinery falls under class 53 and has a 50% CCA rate. In this situation CCA is calculated as UCC multiplied by the CCA rate. The following examples shows CCA in 2016, 2017 and 2018.

CCA is also impacted by other tax laws such as the half-year rule, short fiscal year rule, available for use rule, recapture and terminal losses which will be addressed in subsequent sections of this text. The rates for different classes can be found in the Income Tax Regulations 1100(1). In general, the rates are intended to reflect the anticipated depreciation of the related assets. So, for example buildings, which tend to have a long useful life, will have a relatively low CCA rate (usually 4%) whereas computer software, which tends to depreciate quickly, has a much higher CCA rate (up to 100%).

Why are items typically ‘pooled’ into the same CCA class?

Assets are pooled into certain classes largely because the government believes they depreciate in a similar manner. For example, tools, medical and dental instruments, and kitchen utensils are grouped together in class 12. Similarly, roads, parking lots, sidewalks, airplane runways, storage areas or similar surface construction are pooled into class 17. The assets in these classes really don’t have much in common other than the belief that they depreciate the same way.

Interactive question (Author: Daljinder Nijjar, March 2019)

Interactive question (Author: Amarpreet Kaur, June 2019)

References and Resources:

- ITR 1100(1)

- Video – “CCA Part 1 2015” (Author: BCC Education)

- Article – “Income Tax Folio S3-F4-C1, General Discussion of Capital Cost Allowance” (Author: Government of Canada)

- Article – “CCA classes” (Author: Government of Canada)

- Competency map: 6.3.2

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.