26 What are the available income splitting opportunities with family members?

Anita Kartawidjaja

What is income splitting?

Income splitting is a tax saving strategy where you basically allocate income from one family member who has higher income, to another family member who has lower income. The point of this is so that the higher income family member can transfer a portion of their income to another family member who has lower income, and that way they can report their own income at a reduced amount on their tax return, so that they can be taxed at a lower tax bracket. This will usually help reduce the entire family’s overall tax bill.

Pension Income Splitting

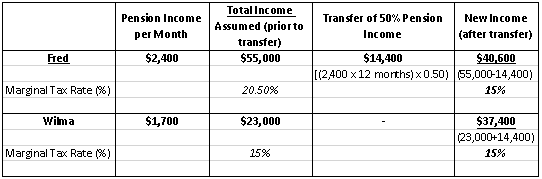

There is an income splitting strategy called Pension Income Splitting. This is where individuals can split their eligible pension income (monthly income in retirement) with a spouse or a partner, if all the requirements are met. ITA s. 60.03 states that the individual that receives the pension, can transfer up to 50% of their eligible pension income to their spouse or partner. This is also beneficial in that it can possibly create or increase the pension income tax credit for the spouse so they can deduct this amount from their taxes payable (see ITA s.118(3) for more on pension income tax credit).

Ex.

Contribute to a spousal RRSP

If an individual believes that they will have a higher income than their spouse upon retirement, this income splitting opportunity would be very beneficial in the year of withdrawal, in terms of tax saving. The higher income individual can contribute to their spouse’s RRSP, and when the funds are withdrawn, it would be taxed under the spouse’s name (with the lower income) instead of the contributor’s name (with the higher income).

Loaning money to your spouse or child (Prescribed Rate Loan)

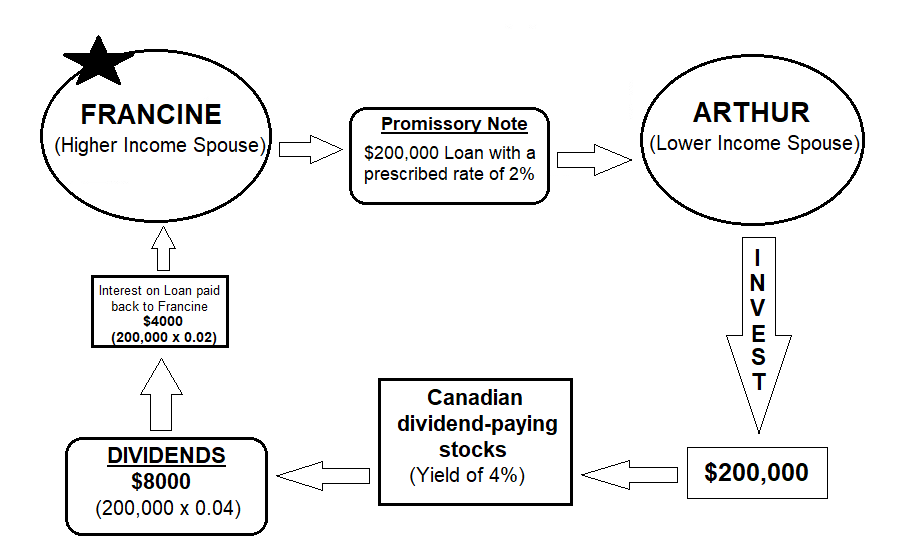

If one spouse or partner is in a higher tax bracket than the other, they could lend money to the lower income spouse and/or to one of their children. It is suggested that a promissory note be written for the loan to secure it. Also, the loans must charge interest at the prescribed rate for benefits (or the commercial lending rate if it is lower) and this interest amount must be paid by January 30th of each year. The lower income family member can use the loaned funds to purchase investments (e.g. dividend-paying stocks), and the income will be taxed and paid at a lower marginal rate by the lower income family member. Another thing the lower income family member can do is use a portion of the dividend income they earned to pay the interest on the loan to the higher income family member. The prescribed rate on benefits is usually pretty low (2% as of January 2020) so, as long as the investment has a higher return than the prescribed rate, your income splitting strategy is a success.

Prescribed Rate Loan Example:

Image: Anita Kartawidjaja (January 2020)

There are many more income splitting strategies other than the ones listed here, but these are few of the more common examples that tax savers take advantage of.

interactive content (Author: Masood Abdullah, January 2020)

References and Resources:

- ITA – 60.03, 74.5(1)

- Article – “Pension income splitting” (Author: Government of Canada)

- Article – “Here are your income splitting options now that the private corporation avenue is dead” (Author: Jamie Golombek)

- Article – “Lend Money to Your Spouse or Child” (Author: TaxTips.ca / Boat Harbour Investments Ltd.)

All media in this topic is licensed under a CC BY-NC-SA(Attribution NonCommercial ShareAlike) license and owned by the author of the text.

Image Description

Figure 27.1 Image Description: Fred’s pension income per month is $2,400 with a total income of $55,000. Wilma’s pension income per month is $1,700 with a total income of 23,000. Fred plans to transfer 50% pension income to his partner [(2,400 x 12 months) x 0.50]. His new income would become $40,600 (55,000-14,400) and his partners would become 37,400 (23,000+14,400). [Return to Figure 27.1]

Figure 27.2 Image Description: Francine is loaning $200,000 to her spouse Arthur with a prescribed rate of 2%. Arthur decides to invest the money into a Canadian dividend-paying stocks at 4%. He earned $8000 as a dividend (200,00 x 0.04). Then he paid the interest of the loan back to Francine of $4000 (200,000 x 0.02). [Return to Figure 27.2]